The Free Market Center

In the previous two articles I have explained that the judgments of individuals provide the only source of economic value [link to previous post], and the ordinal preferences of individuals provide the only measure of economic value [link to previous post]. So, how can these individual subjective values provide any useful information to those actors and for any outside observer?

The subjective values of individuals become useful to the market when an exchange occurs. Let me demonstrate with a very simple hypothetical example.

Two individuals, John and Charles, have a chance encounter. John happens to have with him an item that I will refer to as “A.” Charles has with him and item that I will refer to as “B.” We cannot hear their conversation but we noticed that when they part John and Charles have exchanged these items. Now Charles has A; and John has B. This exchange gives us as observers — and also John and Charles as participants —— some information about how they respectively value these items.

Although prior to this exchange we knew nothing about the preferences of either John or Charles, we can now say with absolute certainty that John prefers B more than A, and Charles prefers A more than B. In general, when an exchange occurs we can always say that each party to the exchange gets what they value more than what they give. We have no way of measuring how much more they value what they get, but we can say with certainty that they do you value it more.

We have confidence in what we know about these relative values simply because the exchange occurred. If John and Charles did not value what they got more than what they gave up, the exchange simply would not have occurred. To add a little clarity let’s look at three other possibilities in which an exchange would not have occurred.

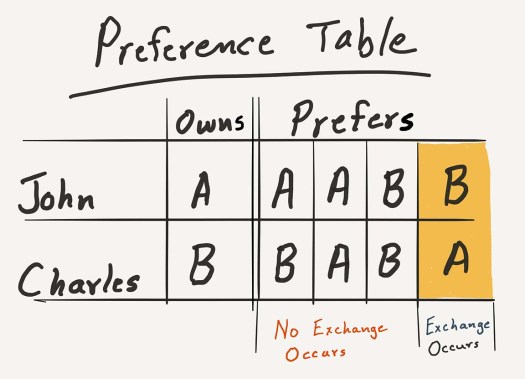

The following graphic shows the alternatives possible when John and Charles meet. Notice that, in these possible scenarios, no exchange occurs when either party prefers what they already have—no matter what the other party prefers.

When John and Charles happened to encounter each other they experienced what economists refer to as a double coincidence of wants: each of them wanted what the other had more than what they possessed. In a worldwide economy, consisting of billions of participants and billions of products, the double coincidence of wants occurs fairly rarely. I will discuss the more complex nature of market exchanges later. This hypothetical example, however, provides a simple demonstration of how the subjective preference scales of individuals become exposed by their actions.

I do want to point out the most important common element in the sources and measure of value and the market exchange: the individual. The values and actions of individuals represent the core of all economic activity.

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: