The Free Market Center

The Free Market Center

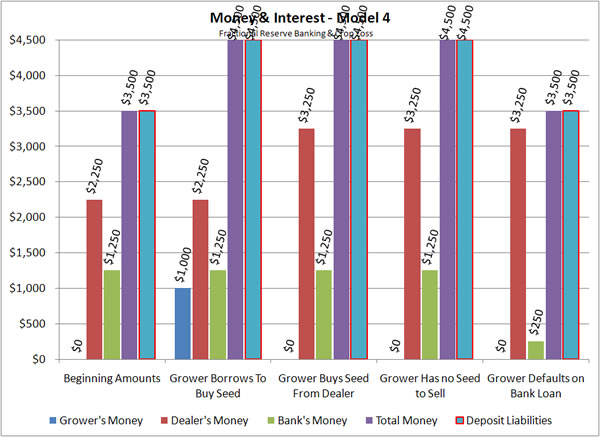

This model—also based on a fractional reserve banking system—begins the same as the three preceding models. The first two transactions are the same as they were in models 1, 2, and 3. The grower borrows money from the bank. The grower then buys seed from the seed dealer. Then a catastrophe happens. The entire crop of the grower gets wiped out by a flood. (He quickly leaves town.)

| Beginning | Transaction #1 | Transaction #2 | Transaction #3 | Transaction #4 | |

|---|---|---|---|---|---|

| Beginning Balance | Grower borrows $1,000 | Grower buys corn seed for $1,000 | Grower's crop fails. He has no seed to sell. | Grower defaults; leaves town. Bank takes a bath. |

As a result of the grower's disaster, the third transaction (the fourth set of bar graphs), the sale of corn seed, does not occur, and none of the balances change, because the grower has no seed to sell back to the dealer. At that point the dealer and the bank have exactly the same amount of money as they did after the grower bought the seed from the dealer.

When the grower's note comes due the bank must bear the entire loss as a result of the grower’s default. The bank declares the note from the grower worthless and reduces the bank's deposit liabilities and the amount in their own account by $1,000.

Notice: During the period in which the grower’s loan is outstanding the quantity of money, similar to model #2, increases by $1,000 to $4,500. When the bank writes off its loss, it reduces both its account—to reflect the loss—and the bank liabilities by $1,000 returning total money and the total bank deposit liabilities to $3,500.