The Free Market Center

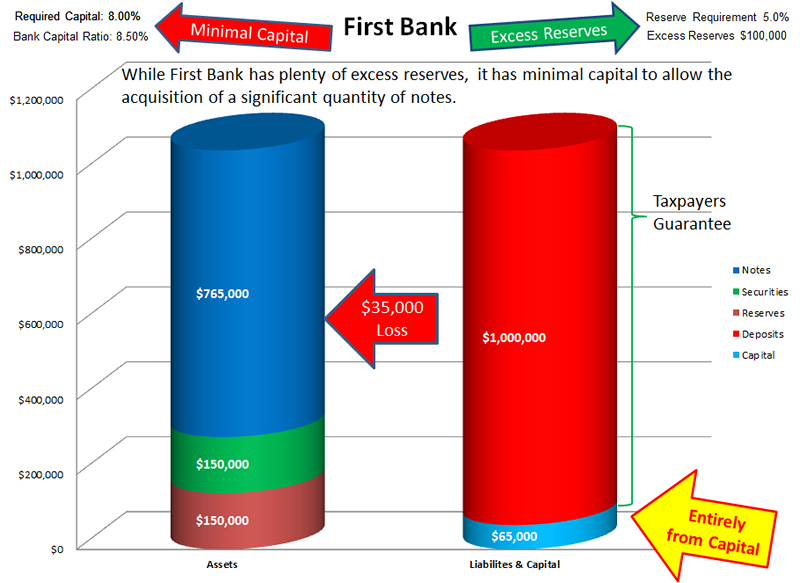

If First Bank suffered a loss of $35,000 as a result of note default, that would amount to only 4.375% of the bank’s risk assets (of $800,000) — significant, but not terrible. That loss, however, would come entirely from the capital of the bank — 35% of the $100,000 of capital. The capital structure of the bank (a ratio of 8.50% of risk assets) would fall to near the threshold of the capital requirements. The bank officers would become much more cautious about their future loan criteria.

But, would the holders of deposit accounts have any risk?

As a practical matter taxpayers guarantee the bank deposit accounts. Technically the Federal Deposit Insurance Corporation (FDIC) guarantees the banks deposit accounts (with a few minor exceptions). In the long-run, because of the limited financial capacity of the FDIC, the government must guarantee those deposit accounts.

What effect does this have on the bank’s ability to create more deposits and buy more notes?

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: