The Free Market Center

First, banks increase their deposit liabilities when they accept either checks (drawn on other banks) or cash for the account of either new or existing customers.

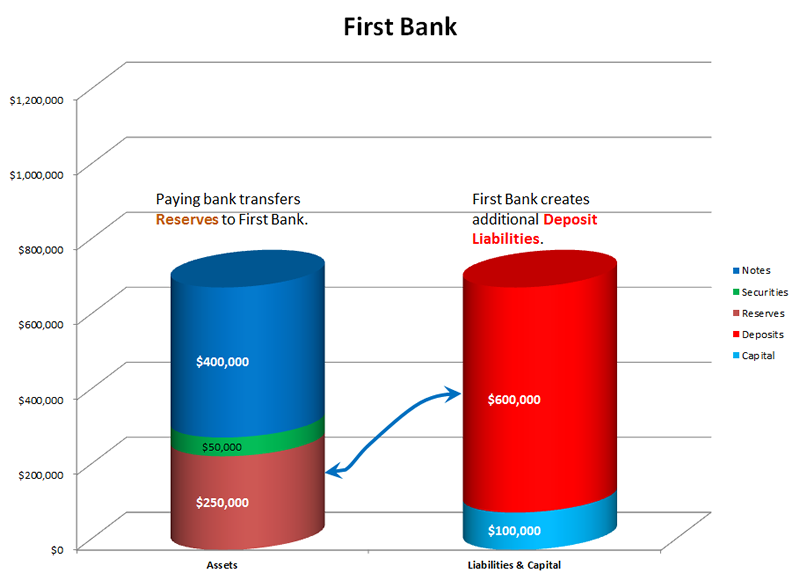

When First Bank accepts a check drawn on another bank for the account of a new or existing customer, the bank on which the check is drawn transfers reserve dollars, in an amount equal to the amount on the check, into the reserve account of First Bank. In return for the reserve dollars deposited into its account at the Federal Reserve, First Bank increases its deposit liabilities by an equal amount of money dollars – for the account of the depositing customer.

When a bank receives cash for the account of a new or existing customer they add the amount of that cash to the amount of their reserves (referred to as cash in vault, also included in bank reserves) and they create a deposit liability of an equal amount. (To keep it simple, I have not used a cash deposit for this example.)

In all cases, when customers transfer funds to a bank, either in the form of cash or by the use of the check, the amount of deposit liabilities and the amount of bank reserves rise by an equal amount.

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: