The Free Market Center

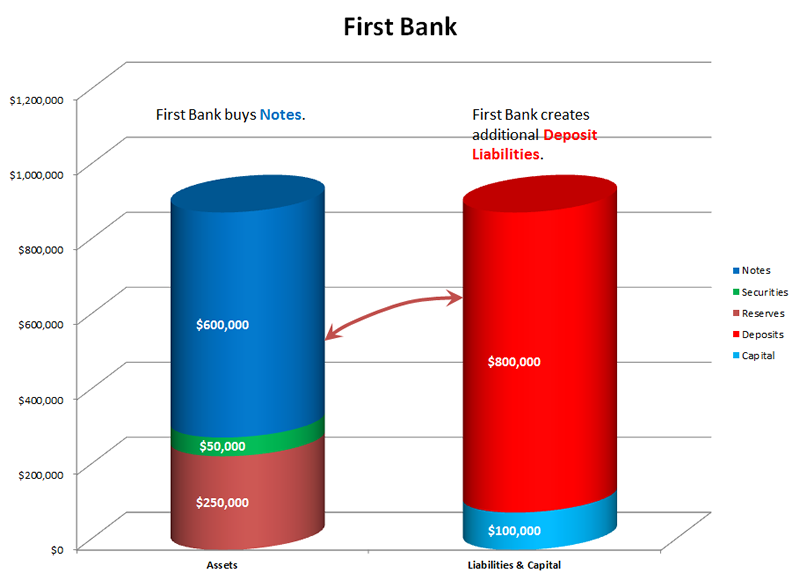

Second, banks increase deposit liabilities as a part of the transaction in which the bank acquires note obligations.

Banks assume deposit liabilities for the purpose of making profitable investments, mostly in the form of interest-bearing notes from their customers. The banks acquire these notes by simply creating deposit liabilities with a ledger entry to their bank records.

In the case of this example, as you see, deposit liabilities of First Bank increased by $200,000 to acquire notes for future money in the amount of $200,000. The note also includes the obligation on the part of the note maker to pay interest. Over the term of the note, interest payments (paid by check from another bank) add to bank reserves and bank capital.

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: