The Free Market Center

The Free Market Center

Transactions in which The Fed buys securities from non-banks (usually through a broker-dealer) come as close as possible to The Fed actually injecting money into the economic system. These transactions, however, still require banks to create the money.

In this example in The Fantasy Banking System, The Fed buys 500,000 M-oz. of securities from a non-bank. Since non-banks do not have accounts with The Fed, the transaction gets a little complicated:

Transaction number 2 actually creates new money in the banking system.

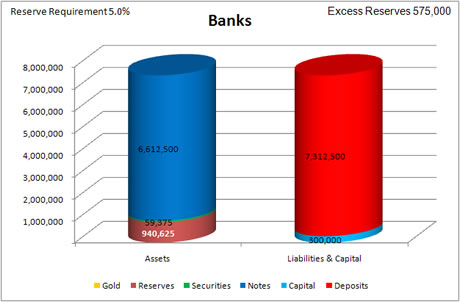

Although this transaction adds 500,000 R-oz. to the reserves of the bank in question, it adds less than 500,000 R-oz. to the excess reserves of that bank. Unlike transactions directly with The Fed, this transaction simultaneously adds to the bank reserves and to The Banks' deposit liabilities. Thus, 25,000 R-oz. of the 500,000 R-oz. added to reserves apply to meeting the reserve requirement on the additional 500,000 M-oz. of deposit liabilities. The transaction increases excess reserves by only 475,000 R-oz.

| Assets | Liabilities & Capital |

|---|---|

| Increase Reserves by 500,000 R-oz. | Increase Deposit Liabilities by 500,000 M-oz. |

| Assets | Liabilities & Capital |

|---|---|

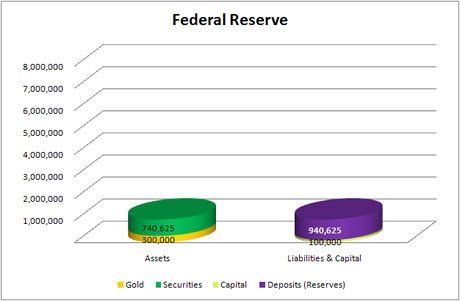

| Increase Securities by 500,000 M-oz. | Increase Deposit Liabilities (Reserves) by 500,000 R-oz. |

Whether or not The Fed's purchase of securities affects the quantity of money immediately depends on the type of seller. As we've seen above, when member banks sell securities to The Fed, it causes no increase in The Banks deposit liabilities, and therefore, no increase in the quantity of money.

When The Fed buys securities from a non-bank entity, the credit that it makes to the Deposits (Reserves) of the seller's bank creates an obligation on the part of that bank to make an equal credit to its deposit liabilities for the account of the seller.

This transaction, unlike the one in which The Fed buys securities from a bank, does result in an increase in the money supply. This transaction, however, requires the actions of a bank to create new money—in the form of bank deposit liabilities—to pay the seller.

The Fed, by buying securities from non-bank entities, has the indirect effect of causing banks to create money to complete that transaction. But, it does not mean that The Fed actually creates money with that transaction.

When one hears that the Fed is buying securities in the open market, he cannot tell whether that transaction increases the money supply without knowing the type of entity making the sale.

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: