The Free Market Center

The Free Market Center

I have demonstrated in the preceding pages how banks and The Federal Reserve cause changes in the money supply. The money supply can expand and contract when banks and The Federal Reserve buy and sell assets. Whether or not money actually gets created depends on which entity – banks or The Federal Reserve – conducts the transaction and the nature of the other party to the transaction. This brief outline depicts when money gets created or destroyed based on the entities involved.

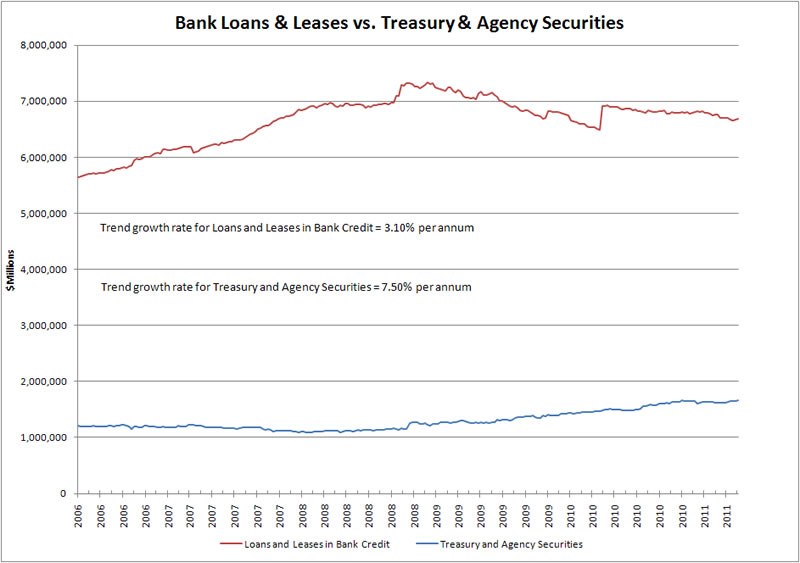

With that concept in mind, please consider the following chart.

Have recent purchases of government securities by The Federal Reserve actually expanded the money supply?

You cannot answer this question simply by knowing that The Federal Reserve has purchased quantities of government securities. One must also know whether banks have been net buyers or sellers of financial assets.

Since I do not intend to postulate a definitive answer to my question, I have not presented a chart depicting the activities of The Federal Reserve. The chart above, however, shows important activities by banks for the period from 2006 to 2011.

During the period from 2008 to 2011 two things have happened in banks' investment portfolios. Banks have been buying treasury and agency securities, which increases the supply of money. At the same time, loans and leases have been declining, which decreases the supply of money. Since banks have been net sellers of these two types of assets, they have made a net reduction in the quantity of money.

To answer my question about whether The Federal Reserve has actually expanded the money supply you must know whether the effects of Federal Reserve purchases exceed the effects of the reduction in bank assets.

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: