The Free Market Center

The Free Market Center

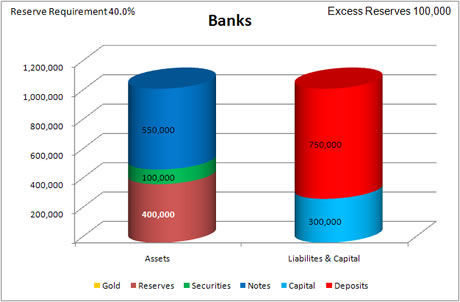

Finally, after waiting several months, The Banks have customers who need money and want to offer their notes in exchange (or borrow money).

Since banks earn their income buying notes (making loans) they want to accommodate their customers' requests. This time they acquire 150,000 M-oz. of notes for which they add 150,000 M-oz. to their deposit liabilities.

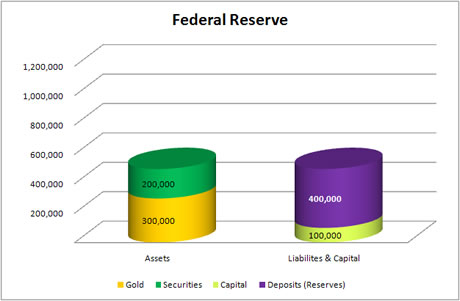

This transactions does not involve The Fed and therefore does not effect The Fed's balance sheet.

| Assets | Liabilities & Capital |

|---|---|

| Increase Notes by 150,000 M-oz. | Increase Deposit Liabilities by 150,000 M-oz. |

| Assets | Liabilities & Capital |

|---|---|

| No effect on Fed's accounts. |

The increase of 150,000 M-oz. in The Banks' deposit liabilities also amounts to 150,000 M-oz. of new money. The acquisition of notes has no effect on the balance of their Reserves account. Instead of giving “loan” customers an asset, they give them a liability from The Banks (which fits our definition of money in that it provides a claim on a current economic good).

Keep an eye on the "Reserve Requirement" and the "Excess Reserves" on the Banks chart. Based on the 40% reserve requirement the excess reserves have declined to 100,000 R-oz.

Should depositors worry yet? You decide.

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: