The Free Market Center

The Free Market Center

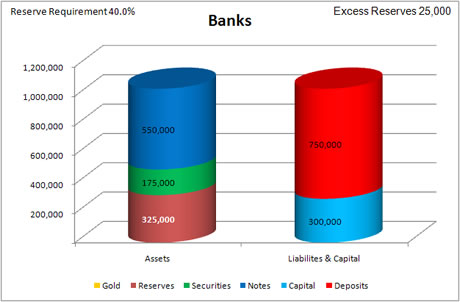

Since they do not earn anything on their reserves (that has changed in the U.S. with current law), the bankers decide to buy 75,000 M-oz. of securities from The Fed. Again, this consists of trading one asset for another—Reserves for Securities.

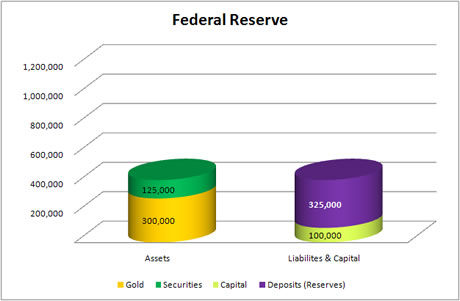

The Fed reduces its securities by 75,000 M-oz. to reflect the transfer to The Banks (notice the change in the green color). In return for these securities they get to reduce their deposit liability to The Banks by 75,000 R-oz.

| Assets | Liabilities & Capital |

|---|---|

|

| Assets | Liabilities & Capital |

|---|---|

| Decrease Securities by 75,000 M-oz. | Decrease Deposit Liabilities (Reserves) by 75,000 R-oz. |

This transaction does not effect the quantity of money. It does, however, reduce The Banks' capacity to create new money, because it has reduced the amount of excess reserves from 100,000 R-oz. to 25,00 R-oz.

The Fed makes offsetting entries on its books to reflect its part in this transaction. The Fed reduces its holding of securities by 75,000 M-oz. and it also reduces its liabilities to The Banks by 75,000 R-oz. Notice: Securities get transferred to (and from) The Fed. Only gold and securities actually move to and from The Fed. Bank "Reserves" do not.

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: