The Free Market Center

The Free Market Center

To increase their earnings, The Banks buy 62,500 M-oz. more notes. Again, they pay for these by adding to their deposit account liabilities. But, with the strong loan demand, why have they not made more loans?

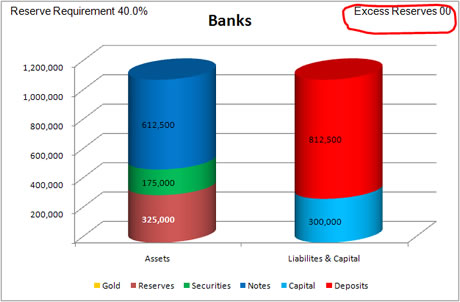

The Banks must cease making loans because they have run out of excess reserves. They don't want to risk the wrath of The Fed by making more loans and having their actual reserves fall below the required level of reserves. Notice: The excess reserves have fallen to 0.00 R-oz. (note red circle).

| Assets | Liabilities & Capital |

|---|---|

| Increase Notes by 62,500 M-oz. | Increase Deposit Liabilities by 62,500 M-oz. |

| Assets | Liabilities & Capital |

|---|---|

| No Effect on Fed's accounts. |

This transaction increases banks' deposit liabilities and the quantity of money by another 62,500 M-oz.

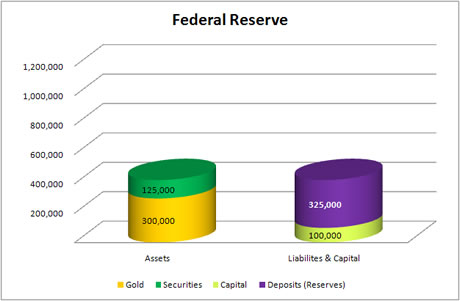

The Banks have now created 512,500 M-oz. of money (i.e. deposit liabilities) more than the original amount of their gold reserve assets (100,000 M-oz. as a capital contribution plus 200,000 M-oz. in initial deposits). Since then, they have turned their gold over to The Fed and made net sales of securities to The Fed sufficient to raise their reserve assets—their deposits at at The Fed—by 25,000 R-oz. (from 300,000 R-oz. to 325,000 R-oz.) Together, those transactions have left them with exactly 0.00 R-oz. excess reserves.

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: