The Free Market Center

The Free Market Center

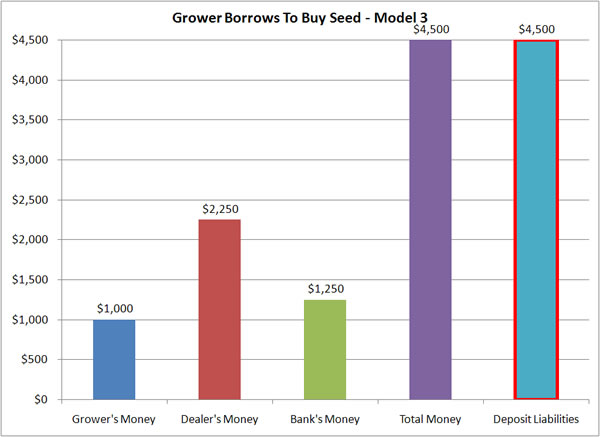

From the viewpoint of parties outside the bank the next two transactions appear exactly the same as in models 1 and 2. The difference lies in the creation of new money by the bank. Instead of making a commitment of their own money, the bank simply makes a promise to the grower to immediately honor any checks the grower writes. (Some might consider this an empty promise, because the bank has now promised more dollars than it has commodity money.)

| Grower | Dealer | Bank | Money/Deposits |

|---|---|---|---|

| Receives $1,000 from loan. | Not involved. | Bank does not use any of its own money to fund this loan. | Bank adds $1,000 to grower's account by simply creating an additional liability for the Bank. |

| Account Balance: $1,000. |

Account Balance: $2,250. |

Account Balance: $1,250. |

Total Money: $4,500. Deposit Liabilities: $4,500. |

In this fractional reserve system, the bank does not need to use its own money to buy notes (i.e. make loans). It just adds to its liabilities.

Notice: The bank has created $1,000. Money that did not exist before.

Please notice in this loan transaction the amount of deposit liabilities and the total amount of money increase from $3,500 to $4,500. This happens as a result of the structure of the fractional reserve banking system. In this system, banks do not need to retain commodity money equal to the amount of their demand deposits. They only need to retain commodity money equal to a fraction of the amount of deposit liabilities.