The Free Market Center

The Free Market Center

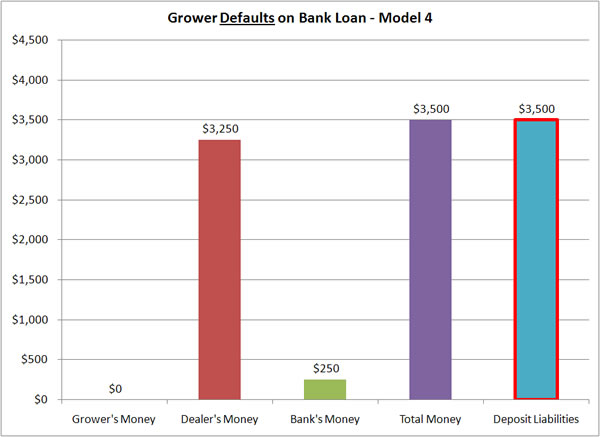

| Grower | Dealer | Bank* | Money/Deposits |

|---|---|---|---|

| Defaults on loan. Does not pay principal or interest. | Not involved |

Receives nothing from grower. Writes off $1,000 of lost money. | Money "destroyed" by bank write-off: $1,000 |

| Account Balance: $0.00. |

Account Balance: $3,250. |

Account Balance: $250. |

Total Money: $3,500. Deposit Liabilities: $3,500. |

* Bank absorbs entire loss in its own account.

As with model #2, the grower has no money, and the bank must absorb the entire loss. But, what effect does this have on the bank's deposit liabilities and the total quantity of money in this fractional reserve banking system?

The bank lists a worthless asset—the note from the grower—at the same amount that they gave the grower for that note. To get it off the bank's books—in essence to pay it off for the grower—they must subtract the bank note of $1,000 and an equal amount from the bank's own account on the bank's books. Since the bank's account consists of a deposit liability from the bank to itself, reducing the bank's account by $1,000 also reduces the bank's deposit liabilities by $1,000—thus, also reducing the total money by $1,000.

In the fractional reserve banking system this write-off has the same effect on the banks liabilities as does a loan pay-off—it reduces total money by $1,000.