The Free Market Center

The Free Market Center

To repay his loan plus interest the grower pays the bank $1,175. That payment consists of $1,000 of principal plus $175 of interest.

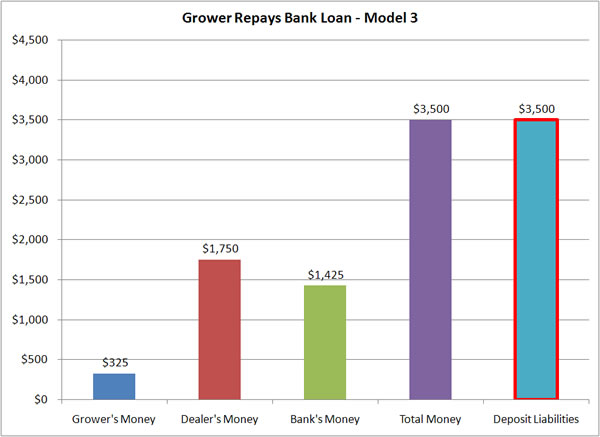

Within a fractional reserve banking system an interesting thing happens when loans are repaid. The money that was artificially created for the purchase of the note from the borrower gets expunged. As a result, the total deposits and the total quantity of money return to the original amounts—$3,500 each.

| Grower | Dealer | Bank | Money/Deposits |

|---|---|---|---|

| Pays the bank $1,175* | Not involved |

Receives $175 in interest from grower.** | Money "destroyed" by principal payment: $1,000 *** |

| Account Balance: $325. |

Account Balance: $1,750. |

Account Balance: $1,425. |

Total Money: $3,500. Deposit Liabilities: $3,500. |

* The grower pays the Bank $1,175 ($1,000 principal plus $175 interest.)

** From that amount the Bank adds $175 to its own account for the interest earned. (I have ignored operating costs.)

*** The principal payment reduces the bank's deposit liability to the grower by $1,000, which simultaneously reduces the bank's deposit liabilities and total money by $1,000.

After paying the loan the grower now has $325 in his account; the dealer continues to have $1,750; and the bank now has a balance of $1,425.

The grower’s balance of $325 represents the money profit, after paying his interest, that the grower made on the seed he sold to the dealer (he has also profited by 900 bu. of corn seed in his inventory.) The $1,425 balance for the bank consists of the original balance of $1,250 plus the $175 in interest earnings for the bank. The dealer, although he now only has $1,750 in his account—less than he had in the beginning—has 800 bushels of corn seed in his inventory that he did not have when this whole transaction began.

Notice: The repayment of the loan returns the supply of money to the original level—even after the payment of interest.

Even under the fractional reserve banking system, although the quantity of money expands for the making of loans (or the purchase of customer notes), the borrower can repay the loan with interest without the ultimate quantity of money in the system having to expand.

I will cover the net changes in all accounts, including the amount of corn, in the summary of this model.