The Free Market Center

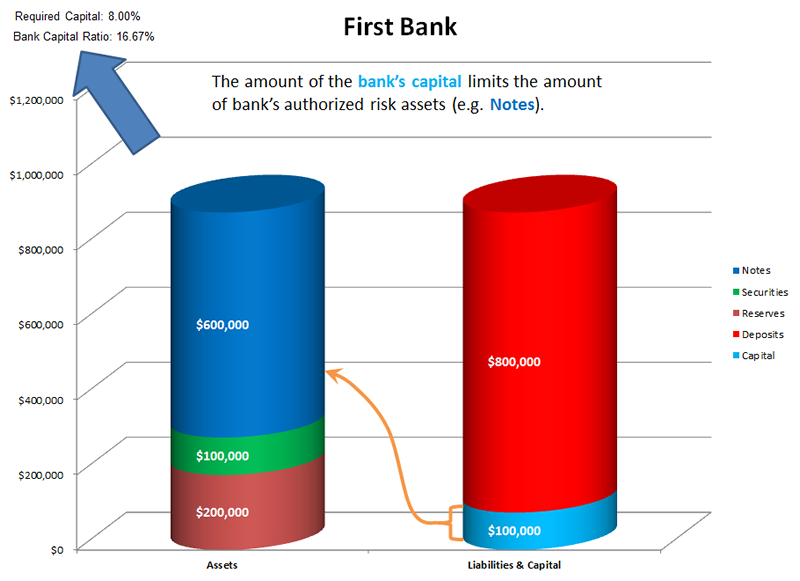

The amount of the bank's capital dictates the limit of the amount of risk assets (e.g. notes) that a bank has authorization to own. According to international agreement banks§ must maintain a specific ratio of capital to the amount of risk assets that they own. Similar to the calculation of the reserve requirement, a bank determines the amount of risk assets it can own based on the inverse of the current capital requirements. Although the calculation is more complicated than in this example, for the sake of example I have used a single capital requirement percent applied to all categories of risk assets. For First Bank, with $100,000 of capital, it can own up to $1.25 million in risk assets, primarily held in the form of notes. (That amounts to $100,000 divided by 8%.)

§ Known as the “Basel Accords.” The capital ratio I have used here serves only as an example. The details of the accords do not matter for understanding the relationship described here.

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: