The Free Market Center

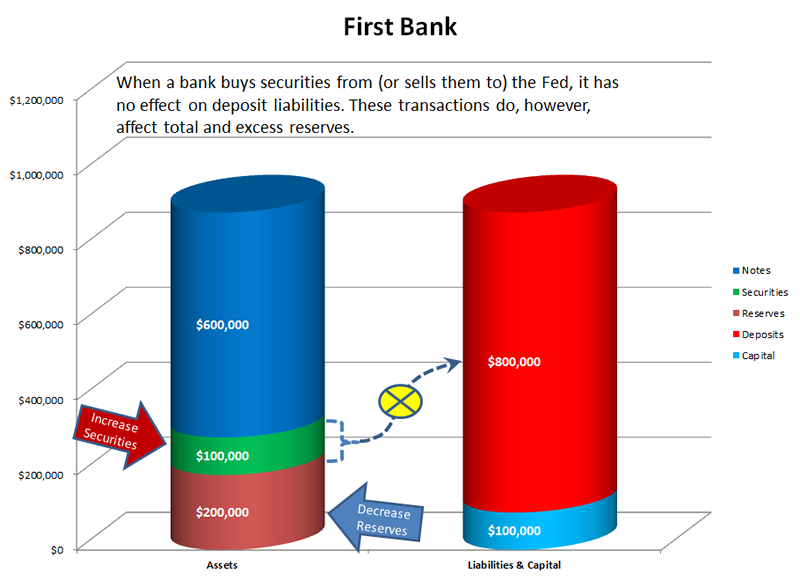

We need to review one last transaction to clarify that it plays no role in the bank’s creation of deposit liabilities (i.e. the increase of the money supply.#) That transaction consists of the purchase and sale of securities with the Federal Reserve Bank. In this case we show the effects of the purchase of securities by First Bank from the Federal Reserve.

As you can see from the comparison of this chart to the previous chart:

This transaction has absolutely no effect on the amount of the deposit liabilities; thus, it has no direct influence on the quantity of money. If the bank were to sell securities to the Federal Reserve, it would have the opposite effect on both the securities and bank reserve accounts and still have no effect on bank deposit liabilities.

It is important to understand the dynamics of this transaction in order to fully understand how the Federal Reserve influences the limitation of deposit liability creation (i.e. money creation). Bank transactions with the Federal Reserve do not by themselves result in an increase or decrease of deposit liabilities (or the increase or decrease in the quantity of money). The banks must act, within the limitation of reserve requirements, to change the quantity of money—by changing deposit liabilities.

#Remember that the monetary aggregates (measures of the money supply) include deposit liabilities.

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: