The Free Market Center

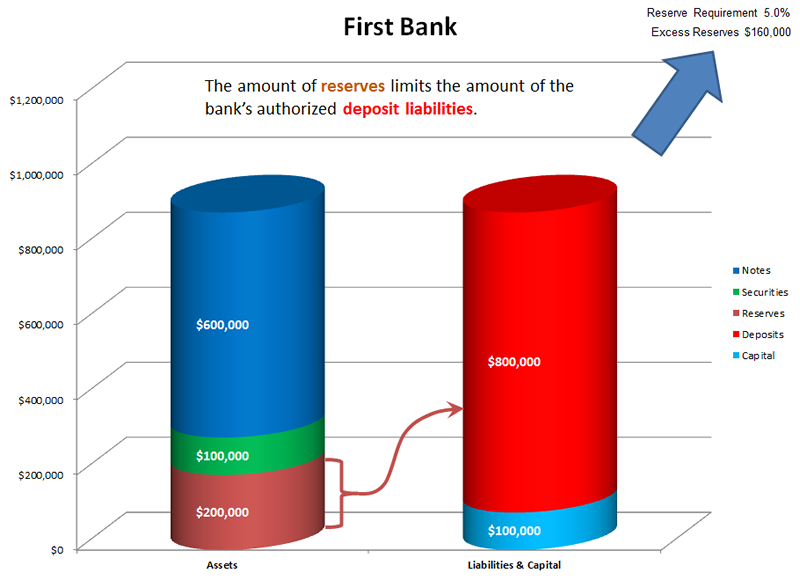

The amount of reserves that a bank maintains, primarily at the Federal Reserve Bank, defines the limit of the amount of deposit liabilities of that bank. Bank reserves limit the amount of deposits through the application of the reserve requirement, stated as a percentage of deposit liabilities.

Banks calculate the maximum of their deposit liabilities by calculating the inverse of the reserve requirement (i.e. dividing actual reserves by the reserve requirement). In the case of First Bank—with $200,000 of bank reserves—the bank could assume a maximum of $4 million in deposit liabilities based on the 5% reserve requirement used in this model. ($200,000 divided by 5% equals $4 million.)

Although Federal Reserve regulations state the required reserves as the amount of reserves required in terms as a percentage of deposits, the quantity of reserves the bank holds actually limits the amount of deposit creation by the bank. When the bank has a reserve balance (actual reserves) greater than their required reserves they have excess reserves (actual reserves less required reserves = excess reserves).

The amount of excess reserves a bank holds determines how much that bank can increase its deposit liabilities before it reaches its limit. Banks can increase their deposit liability limitation (increase excess reserves) primarily by two of the transactions that we reviewed before: 1) the transfer of reserves from another bank to cover a check transaction, or 2) the sale of securities to the Federal Reserve.

In our model, the required reserves of First Bank amount to $40,000 ($800,000 times the 5% reserve requirement.) First Bank, however, has $200,000 in actual reserves, so their excess reserves amount to $160,000 ($200,000 in actual reserves less $40,000 of required reserves.) Based on the reserve requirement alone, First Bank could hypothetically increase its deposit liabilities by $3.2 million ($160,000 in excess reserves divided by the 5% reserve requirement.)

We will find out later that reserve requirements alone may not limit the capacity of First Bank to create deposit liabilities.

If bank reserves limit deposit expansion, what, then, limits the increase in risk assets?

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: