The Free Market Center

“The Fed is Too Tight.” “The Fed is Too Loose.”

The validity of this statement collapses under the weight of the fallacious presupposition that the Fed could possibly hit the right monetary target—either money quantity or interest rates.

The right quantity of money consists of whatever exists at the close of business today, fixed at that quantity forever.

Money interest rates, on the other hand, result from the interaction of market actors supplying and demanding future money in exchange for present money.

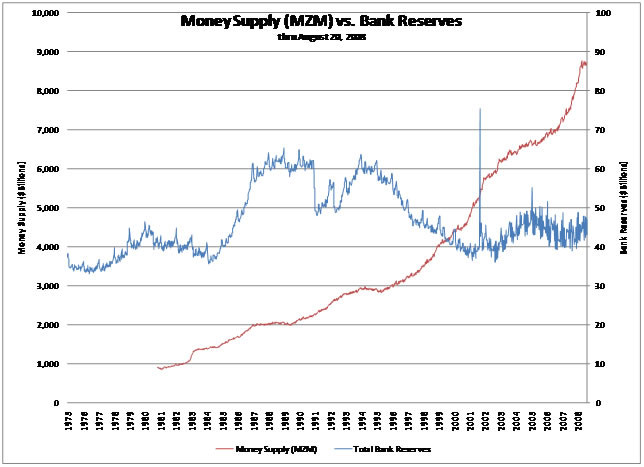

Popular myth says, “The Fed adds to reserves; the money supply increases. The Fed subtracts from reserves; the money supply decreases.” Empirical evidence neither proves nor disproves this statement. It does, however, call it into question.

Over the last 33 years–until September 2008—the money supply has steadily expanded. During that same period bank reserves have risen and fallen. See the following chart:

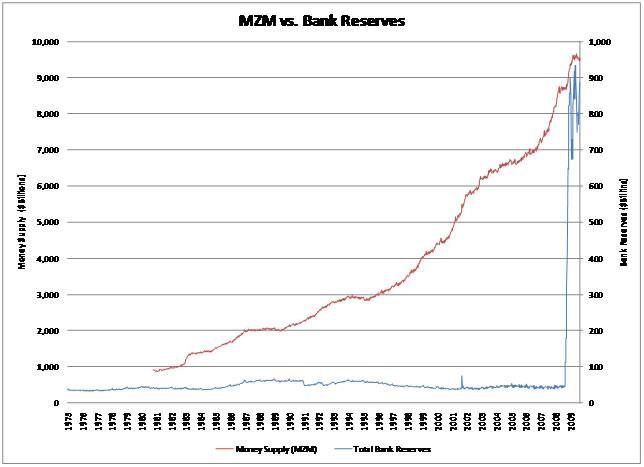

To put that period in perspective, relative to today’s craziness, see the following chart, which includes the months since September 2008:

For those who like heroes and villains, pick your Fed Chairmen heroes or villains from the last five.

| Arthur F. Burns | February 1, 1970 – January 31, 1978 |

G. William Miller |

March 8, 1978 – August 6, 1979 |

Paul A. Volcker |

August 6, 1979 – August 11, 1987 |

Alan Greenspan² |

August 11, 1987 – January 31, 2006 |

Ben Bernanke |

February 1, 2006 – |

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: