The Free Market Center

The Free Market Center

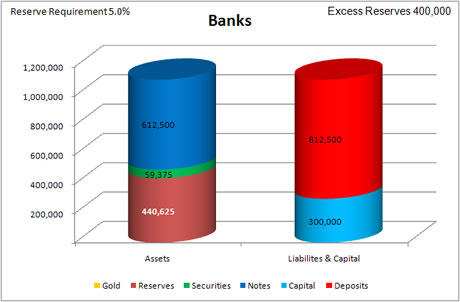

To accommodate The Fed's desire to provide more money to the market, The Banks sell 115,625 M-oz. of securities to The Fed—see the decrease in securities. To balance that entry they add 115,625 R-oz. to their Reserves account (considered a reserve asset).

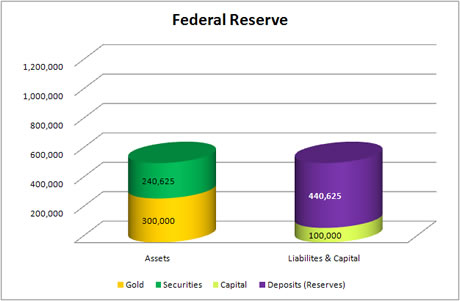

The Fed buys 115,625 M-oz. of securities and adds 115,625 R-oz. to its deposit liability to The Banks.

| Assets | Liabilities & Capital |

|---|---|

|

| Assets | Liabilities & Capital |

|---|---|

| Increase Securities by 115,625 M-oz. | Increase Deposit Liabilities (Reserves) by 115,625 R-oz. |

You can see an important point demonstrated over the last few pages. By changing the reserve ratio and buying securities from The Banks, The Fed has managed to increase bank excess reserves from 0.0 R-oz. to 400,000 R-oz. Yet, bank deposit liabilities (ergo the money supply) has remained the same.

In the Fantasy Banking System, The Fed has taken every action it can to increase the flow of funds; all to no avail. (Do you question the effectiveness of QE 1,2,3, etc. now?)

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: