The Free Market Center

The Free Market Center

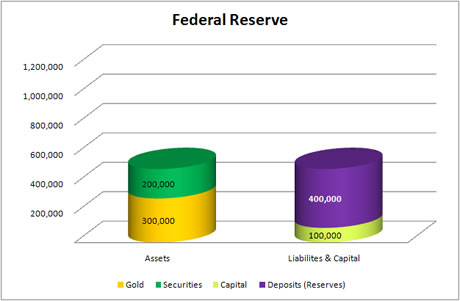

The Fed took The Banks' gold and substituted The Fed's deposit liabilities to The Banks, in part, because it wanted to be able to expand the supply of money at will. The leaders at The Fed figured that, if they could expand bank reserves, they would simultaneously expand the supply of money. In this transaction they attempt to do just that.

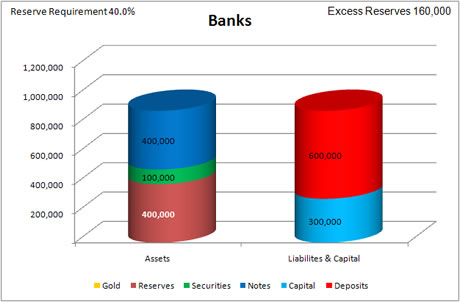

The Fed purchases 100,000 M-oz. of securities from The Banks and pays for it by increasing the deposit liabilities to The Banks by 100,000 R-oz. The Banks' books represent a mirror image of the transactions at The Fed: they decrease their securities account by 100,000 M-oz. and increase their reserves account by 100,000 R-oz..

Does that transaction create new money—as The Fed wishes?

| Assets | Liabilities & Capital |

|---|---|

|

| Assets | Liabilities & Capital |

|---|---|

Increase Securities by 100,000 M-oz. |

Increase Deposit Liabilities (Reserves) by 100,000 R-oz. |

No!

The staff at The Fed discover an interesting phenomenon. After their purchase of securities the amount of reserves in The Banks' accounts does increase; however, no simultaneous increase in bank deposit liabilities occurs.

The Fed must wait for The Banks to buy more notes (i.e. make more loans) before bank deposit liabilities increase thereby increasing the quantity of money. The Banks in The Fantasy Banking System have hit a lull in loan demand.

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: