The Free Market Center

Historically, the stock market has been the most accurate predictor of economic performance. When the major averages rise, the economy tends to rise not long after. Based on this belief, many pundits believe the economy is on sound footing and will continue to grow in the future. But what's the story behind the increase in stock prices?

General rises in stock prices (as represented by stock indices) have two causes. First, since investors prefer to own companies that report rising earnings, the companies in the indices would have to report increased earnings. Second, an increase in the money supply would boost stock prices, in the same way that monetary expansion causes price inflation.

So, let’s take a theoretical look at the causes of rising stock prices.

We might all hope that stock prices rise continually because the majority of companies create and sell more and more products. Analysts tend to take rising earnings as a sign that the companies in question produce more and more goods and satisfy the needs of more and more consumers.

That would provide a sign of a really strong economy with really happy consumers. Using that logic, we would expect production, earnings, and stock price to rise in tandem. But, how likely is that?

If we use stock prices as a proxy for earnings and production, does the rise in stock prices seem reasonable?

In 1971, the Dow Jones Industrial Average equaled 744. In 2024, the DJIA equaled 40,954. In 53 years the average rose 55 times.

Can we reasonably expect the entire average to increase that much in that period of time?

Color me sceptical.

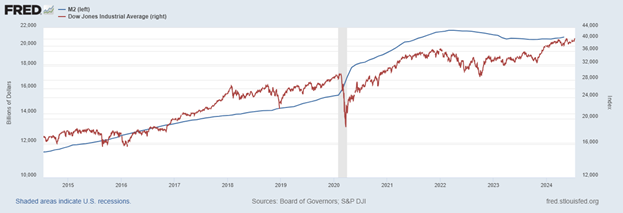

If we examine the rise of the DJIA and the increase in the money supply over the same period of time, we can see an interesting correlation. The pattern of the growth in money shows a very similar pattern to the rise in the DJIA. (I have used log scales on this graph.)

Based on the similarity of these patterns, should we attribute the rise in stock prices to the increase in the quantity of money?

Assuming the accuracy of this connection, the sale of stock at today’s prices will not pay for much more in goods and services than they would have in 1971. Oh, don’t forget that the same government that caused this inflation in stock prices would take a significant portion away in taxes. (And they want more.)

Although most citizens gain either directly or indirectly (through retirement accounts) from the rise in stock prices, a lot of money gets made in what amounts to arbitrage transactions in which underlying production and earning play only a small role. Stock markets turn into money games and not investments. These activities add to the wealth gap that people fret about.

I present this information only for the sake of argument. I want to stimulate important questions. For example:

Does the rising stock market really provide a clear sign of a strong economy or a great wealth transfer that results from government spending financed by monetary expansion?

Do the stock market indices add to a national delusion about our industrial strength?

I do not know. You decide.

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: