The Free Market Center

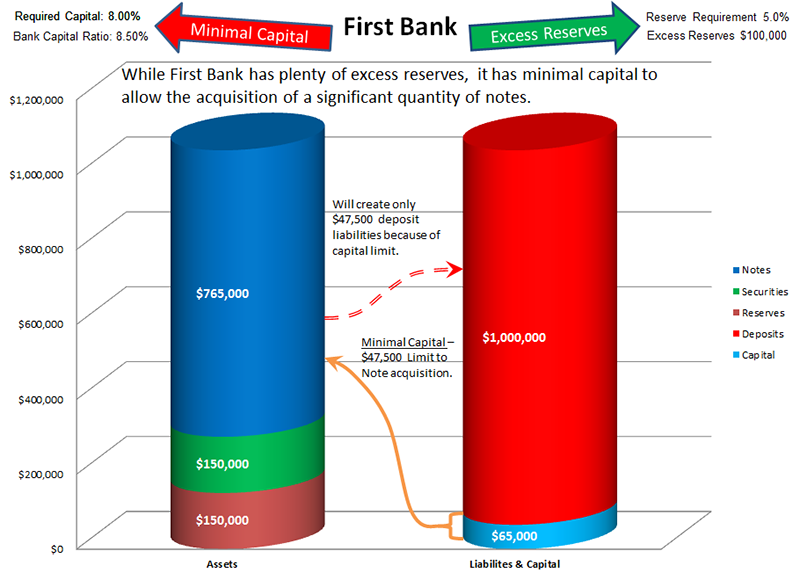

This capital loss does not directly effect the bank’s ability to increase deposit liabilities. They still have $100,000 in excess reserves, which means they could —hypothetically—increase deposit liabilities by $2 Million, but indirectly it does create a limitation.

Because of the deterioration of their capital, First Bank can add only $47,500 to their note portfolio. Since they cannot create deposit liabilities for which they get nothing in return, they will limit additional deposit liabilities to $47,500 to match the assets they can buy. Thus, capital limitations can limit deposit liabilities (money) creation.

So, what happens if the losses grow?…

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: