The Free Market Center

The Free Market Center

With all the talk about QE (Quantitative Easing—i.e. counterfeiting more money) and holding interest rates down (a fantasy in a real banking system), people ignore the most powerful weapon in The Federal Reserve's arsenal for destroying markets: bank reserve requirements.

Let's take a brief look at the "real world" reserve requirements.

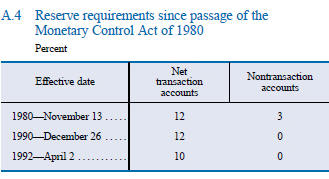

This chart shows the last three major changes in reserve requirements.

See: Reserve Requirements: History, Current Practice, and Potential Reform

The critics of Fed Chairman Alan Greenspan generally overlook the one most significant money inflationary move that The Federal Reserve made during his tenure: establishing the current reserve requirements in 1992.

To have an hypothetically infinite capacity to create new money, banks simply need to shift deposit money from transaction accounts (with an already low reserve requirement) to nontransaction accounts (with no reserve requirement).

Now, those who know something about reserve requirements might say I have moved from one extreme to another with my example—shifting from 40% to 5%. That criticism would prove only half right.

Banks reserve requirements have never, since the inception of The Federal Reserve System, approached 40% . But, the 5% example represents a conservative figure. In 1992 the real Fed lowered reserve requirements to 10% for demand deposits (transaction accounts) and 0% for time deposits (nontransaction accounts). Based on recent deposit make-up the effective required reserve ratio amounts to less than 1% (total required reserves divided by total deposits).

This exceptionally low reserve ratio has significance because it has a direct and immediate influence on the money creating capacity of banks. Since current banking regulation and banking practice give immediate access to time deposits, they have become part of the money supply.

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: