The Free Market Center

The Free Market Center

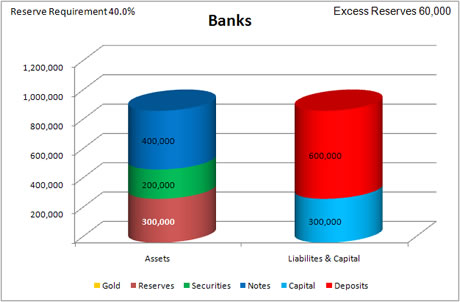

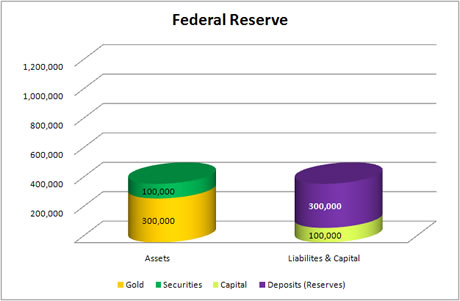

The Banks, by turning their gold into The Federal Reserve, simply trade one asset for another—gold in return for a promise from The Fed. Only gold gets physically transferred. As signified by same color used for gold at The Fed as used for the gold when formerly owned by The Banks on the previous pages. (Click the "To View Before Transactions" to see the shift.)

The new reserve asset at The Banks does not have a corresponding color at the Fed. That asset does not get transferred. The Banks simply give up their 300,000 M-oz. gold and replace that asset on their books with an asset which consists of the promise of 300,000 R-oz. (not necessarily of gold) from The Fed. (This explains why I used M-oz. as units of reserves and excess reserves when they referred to gold—above—and now I use R-oz. as units of reserves and excess reserves.)

The Banks now have accounts with The Fed, which acts as a bank for banks. As a part of this transaction the total of liabilities and capital of The Banks remains the same.

The Fed now owns 300,000 M-oz. of gold received (or taken) from their "customer" banks. To balance their books they show the 300,000 R-oz. deposit liability to The Banks.

| Assets | Liabilities & Capital |

|---|---|

|

| Assets | Liabilities & Capital |

|---|---|

Increase Gold by 300,000 M-oz. |

Increase Deposit Liabilities (Reserves) by 300,000 R-oz. |

Notice that The Banks record an asset called "Reserves" in an amount equivalent to the amount that The Fed records as a deposit liability to The Banks (300,000 R-oz.). I have used different colors on the charts to indicate that they do not consist of the same economic good. The "Reserves" asset of The Banks also has a different color than the gold asset now owned by The Fed. These distinctions will play an important role in your understanding of the transactions between The Banks and The Fed.

Notice in the following pages that The Federal Reserve never transfers gold back to The Banks. Gold ownership for banks has ceased.

The accounts that banks have with The Federal Reserve have limited usefulness. They cannot trade or lend that asset to any private citizen as they can the securities and notes that they own. They can only use those accounts to transact business with The Fed and other banks with membership in The Federal Reserve System.

The implementation of The Federal Reserve makes the fractional reserve banking system official. The Fantasy Banking System now considers liabilities due from The Fed as reserve assets. Thus, these banks continue to meet (and exceed) their minimum required reserves using these new "reserves."

At this point depositors don’t worry much. They figure that, if they want to exchange the banks’ liabilities for gold, that The Banks will simply run down to The Fed and pick up the gold—whether or not that represents the facts.

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: